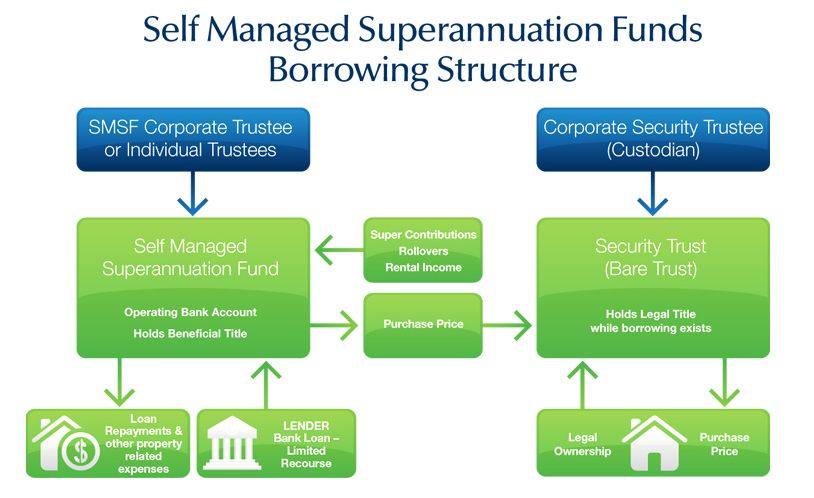

Self managed super funds (SMSFs) can borrow money for the purchase of residential or commercial investment property.

SMSF property investment is an ideal way for you to grow and accelerate your retirement savings. Some of the exceptional benefits in using your SMSF loan as part of your funds investment strategy may include:

- Growing your retirement savings faster

All income and capital growth goes into SMSF which accelerates growth of your super. - Pay off SMSF loan quickly

Super contributions and the property’s rental income are used to pay off the SMSF loan. - Buy commercial premises for business

Your SMSF can purchase commercial property and rent it to a related party business. - Leverage

Opportunity to maximise capital growth as rental income can provide cash flow to fund further property investment. - Provide retirement income

Once your SMSF owns the property outright, rental income can be used to fund pension payments - Reduce tax on contributions / Pay less Capital Gains Tax (CGT)

Loan interest and property expenses are tax deductible to your SMSF which can help reduce SMSF tax liability.

CGT within a SMSF is generally capped and can drop to 0% if the fund is in Retirement phase.

If you have a self managed super fund or are considering establishing your own super fund, a properly structured self managed super fund loan can allow your fund to acquire a real estate asset for capital growth and return.

For more information on SMSF lending, call us now on (03) 9548 1699 or complete our online enquiry form.